Rewarded Research ARPU up 43% after ATT rollout begins

Apple’s ATT initiative is forcing marketers to rebuild the digital infrastructure that has produced some of the most effective user acquisition models ever deployed at scale. The existing methodologies that informed these models are no longer valid, and new models will need to be developed — this transformation is already underway.

As business operators adapt to the new order, Apple's PR around the initiative is driving the point home with consumers as their ATT ad has already clocked over 16M views on YouTube.

While Apple changed their rules of the game — the rules of freemium businesses have not changed. To succeed in a freemium mobile business, operators still need to maximize revenue per user (ARPU) while deploying sustainable user acquisition. ATT has strong implications on both of these disciplines as the IDFA was a crucial component to sustainable ad spending in mobile. Mike Brooks, SVP Revenue @ WeatherBug reported to AdExchanger that CPMs are down almost 50% since the change.

“He estimates that between $6 billion and $12 billion of in-app ad spend must now be reallocated using alternative data-driven targeting or attribution methods – or be lost entirely for the app ecosystem.”

The good news is that the app ecosystem will adapt. Mobile marketers will develop new models to produce the results needed to support their businesses, and creative monetization teams will diversify their strategies in this new era.

The goal of this article is to provide insight into another macro trend happening in the market research industry that is benefitting F2P.

The Research Buyer

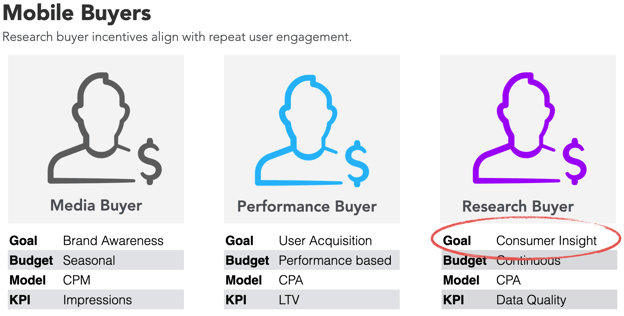

If you’re reading this post, you’re likely aware of two common buyer personas that spend ad budgets on mobile. The media buyer, who buys mobile ads and optimizes for awareness, (i.e. a movie premier) and the performance buyer, who optimizes for high LTV user acquisition. There is also a third buyer in mobile with very different goals, the research buyer.

Research Buyers are trained market research professionals that specialize in quantitative survey research. They sample populations to glean insights that inform business decisions. Bob Iger, former Disney CEO, relied on market research to validate his intuitions and make the case to his board of directors that they should acquire Pixar Studios.

Research buyers are driven by data quality and need access to large, representative audiences to succeed in their research. Their goals are not to acquire new users but to collect anonymous opinion data that informs business decisions (e.g. should we acquire Pixar Studios?).

Old wells are drying up

Research buyers need access to large consumer audiences to collect representative sample. In the past, they have relied on “online research panels”, or groups of people who have agreed to complete online surveys for incentives, to access sample. The problem here is that online panels are shrinking and cookie-based identity resolution is an open door for fraud. As a result, the online panel business is suffering as buyers no longer trust the data and the panel model is not large enough to meet buyer demand — research buyers literally cannot spend their budgets. As a medium, online panels are no longer a viable, scalable solution for research buyers.

“...research buyers literally cannot spend their budgets.”

Enter mobile Rewarded Research

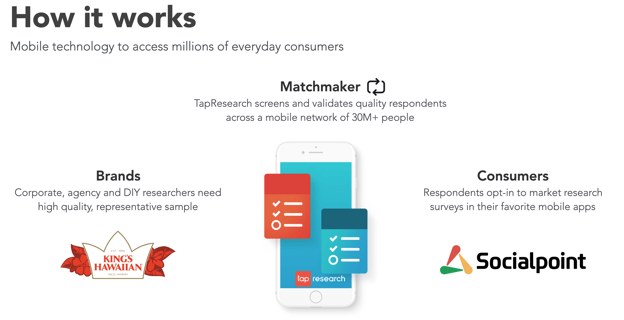

Mobile rewarded research solves the problem for buyers by unlocking access to a massive global audience willing to engage with market research surveys. When a mobile publisher integrates rewarded research into their app or game, they are participating in a massive industry budget shift from online panels → mobile apps and games. Since 2016, TapResearch has been pioneering this transition by connecting enterprise market researchers and brands with the audiences found in our network of mobile publishers.

From a monetization perspective, rewarded research is a great way to monetize an app without ads and is a viable source of revenue to consider during the ATT transition. Rewarded Research experiences are powered by in-app virtual currency and research buyers will pay a premium to access mobile consumers. Because these buyers are not motivated by user acquisition -- these buyers prefer to engage and re-engage users repeatedly, in-app as they match to their research projects.

Players are happy to opt-in and engage with their surveys because they are rewarded, in real-time, with the virtual currency native to the apps they’re using at the time. So if you want to know how to monetize an app without ads, this is it.

IDFA-less monetization

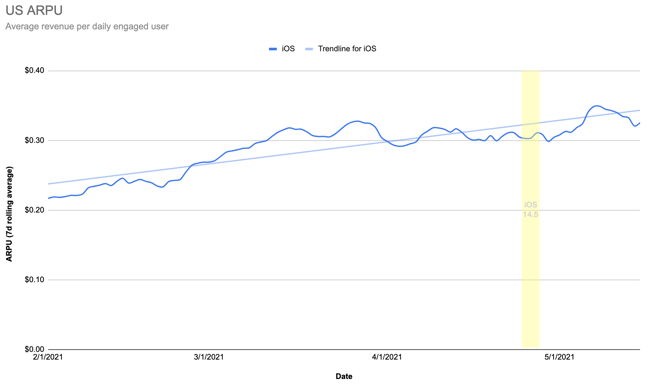

Because the majority of research buyers do not rely on IDFA to conduct research, Apple’s ATT changes have not affected publisher yield across our network.

Average revenue per daily user (or ARPU) in the US has increased over 40% since the introduction of iOS 14.5 across the TapResearch Audience Network:

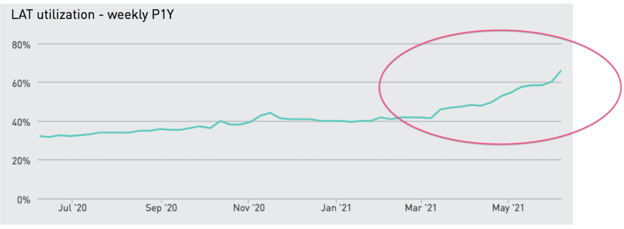

During this time, we’ve also seen a sharp increase in Limit Ad Tracking (LAT) traffic across the iOS network. This trend has not had a negative impact on ARPU because research buyers do not rely on IDFA to buy sample and their need to access consumer audiences is growing as the legacy panel model shrinks.

Ideal Publisher Fit

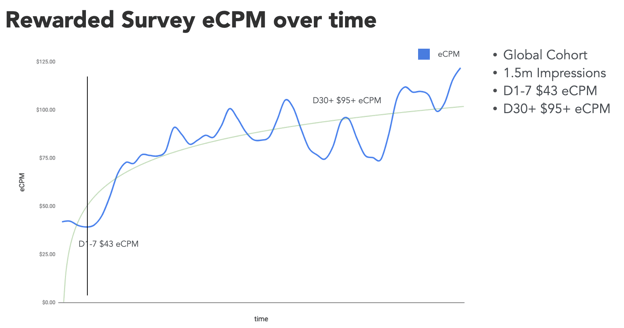

Not all mobile apps are a fit for rewarded research. Mobile apps, and specifically F2P games, that have strong virtual economies generally see the most success with this format. This is because users trade their time for virtual currency — so the stronger the value of the currency — the higher the intent. As intent increases, yield increases. We know this because unlike rewarded video where eCPMs decrease as performance buyers adjust their bids, rewarded survey eCPMs increase over time as users repeat usage and become better respondents. The chart below compares the average eCPMs on D7 vs. D30.

This is an important distinction when considering whether rewarded research is a fit for your app because not all games are designed with a strong virtual currency -- this is the single most important aspect to success with rewarded research formats. The team at TapResearch created this Best Practices E-Book for anyone considering this format in their game.

Success Stories

TapResearch’s rewarded research experiences have been successfully implemented into some of the largest AAA publishers in mobile.

Social Point

Sofia Gilyazova and the team at Social Point have been working with TapResearch for over a year. They’ve successfully implemented an excellent rewarded research experience as a persistent option to earn their hard and soft currencies in both Monster Legends and Dragon City.

“TapResearch opened an entirely new source of revenue for Socialpoint that fit perfectly within our rewarded monetization strategy. Our users quickly adopted the new format and there were no negative impacts to our user support and communities. We’re excited to grow this partnership!” -- Sofia Gilyazova

Pocket Gems

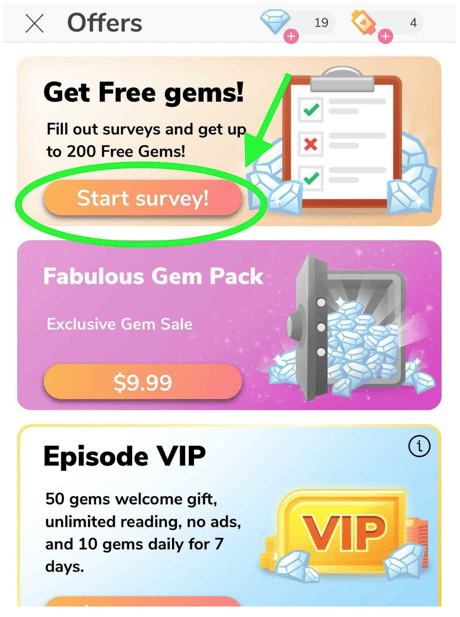

The team at Pocket Gems implemented rewarded research to give their players a new way to earn access into premium content experiences.

One user enjoyed them so much she left this review about her survey experience:

“I take at least one survey every time I open the app to earn gems for a story... Sometimes I open the app just to take a survey because I know I might I want to play later,” said one Episode app user (18 y/o, Female, Georgia)

As the ATT transition continues, TapResearch is helping modern research buyers spend their global budgets on quality sample by partnering with forward-thinking mobile operators eager to diversify their revenue strategy. If you’re like many operators navigating this transition and would like to learn if rewarded research is a good fit for your game or app, we’d love to hear from you.

Our monetization team is trained and happy to consult with you to understand your business goals. They’ll consult with you to diagnose your app and discuss how to best consider rewarded research experiences in your mobile apps.