Opportunities in the Baby Food Market

Nothing is as important as nutrition when it comes to buying baby food.

This unilateral focus came across loud and clear in a survey of Millennial parents that identified nutritional value as the single most important attribute impacting the decision of which food to select for their child, solidly beating out all other options — including price — across all respondents demographics.

At stake is a growing prize. The global baby food market was valued at approximately $63.7 billion in 2019 and is expected to expand to $93.6 billion by 2027, with roughly a third of each total attributed to North America, according to Statista estimates. And new parents are prime targets for marketers, as entry into parenthood is a major life change that certainly affects shopping habits and provides a prime opening for developing new brand loyalty.

Powered by TapResearch’s new Brand Insights solution, the study unearthed a variety of additional insights into 25 to 44-year old parents of infants and toddlers that provide actionable implications for brands and marketers in the highly emotional baby category.

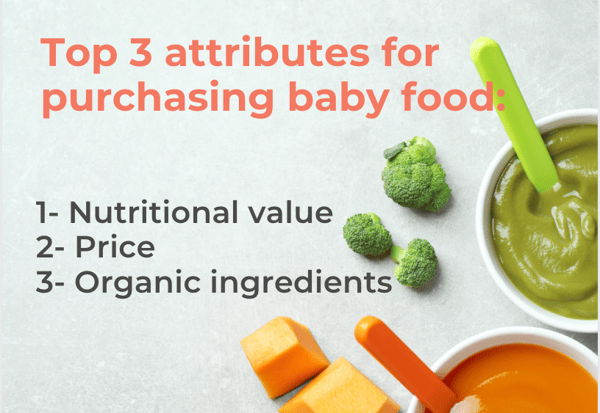

Importance of Baby Food Attributes to Purchase Decisions

While it is not the top consideration, price is generally the second most important attribute considered by Millennial parents. Lower-income families making less than $50,000 a year predictably place a higher value on price than other cohorts, yet nutritional value still ranks supreme.

Organic ingredients take the top third spot overall but this option is followed very closely by the diversity of flavors and a lack of additives/preservatives. Among this middle-tier grouping of attributes, there are some interesting diversions from the general trendline when looking at more specific consumer groups within the Millennial population. For example, organic ingredients are less important to female parents, older Millennials, and consumers residing in the Midwest

Across the board, GMO-free products and re-sealable packaging are generally much less important attributes relative to the aforementioned qualities.

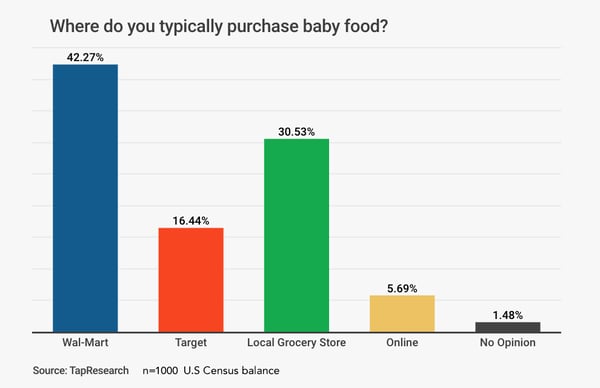

Top Baby Food Shopping Destinations

Walmart is the top baby food purchasing destination, frequented by 42% of respondents, followed closely by local grocery stores, and trailed by Target. Significantly, those shopping at grocery stores tend to place even less importance on price than the overall population.

One of the most surprising results of the survey revealed that only a very small portion (5.6%) of Millennial parents are buying baby food online. WHY?

Well, interestingly, at over 61%, many Millennial parents overwhelmingly said they like in-store purchases over other outlets because they prefer to touch, smell, and pick the food item themselves. This was followed by parents not wanting to pay for delivery fees and that they found a better selection in brick-and-mortar stores vs. online, at 32% and 23% respectively.

Puree Shopping Habits & Brand Awareness

Purees are a popular choice for parents introducing babies to solid foods, with more than half (57%) of respondents feeding purees before they celebrate their child’s first birthday, and another 29% planning to introduce purees soon.

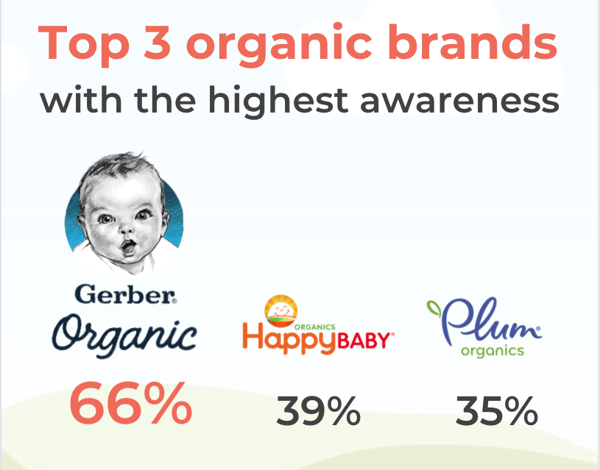

Digging deeper into a sampling of six organic brands presented to survey respondents revealed:

- Nestle’s Gerber organic line claims the highest market awareness with 66% of Millennial parents aware of the brand.

- Danone’s Happy Baby and Campbell Soup Co.’s Plum Organics — the latter often credited with pioneering the baby food pouch market — possess about half that awareness, with 39% and 35% of respondents aware of the shelf-stable brands, respectively.

- A little over a quarter (27%) of Millennials are aware of Yumi, a relatively new entrant in the refrigerated space that promotes its board of nutrition and pediatric experts as a guiding force for its science-led approach, and positions its products as nutrition-first meals and snacks with enriching ingredients tailored to every developmental milestone. The brand offers a custom menu every week based on a baby’s stage of development.

- Once Upon a Farm, a brand offering refrigerated, cold-pressed products co-founded by actress Jennifer Garner, trails with awareness among 20% of respondents. In growth mode, the brand recently closed $52 million in new funding to expand its innovation platform.

- Serenity Kids is the least known of the six brands with only 11.5% awareness. The shelf-stable brand puts an emphasis on meat ingredients and touts its recipes as mimicking the macronutrients of breast milk.

Awareness of the brands is roughly equal across genders, though Serenity Kids stands out with slightly higher awareness among dads than moms, while Plum Organics claims slightly higher awareness among moms compared to dads. Serenity Kids and Yumi also claim more awareness among online shoppers than those shopping at brick-and-mortar locations.

Walmart shoppers are most likely to be aware of Gerber’s organics. That makes sense given that the category leader has ensured high visibility within Walmart’s baby department. The brand also gained high visibility by participating in Walmart’s “Investing in American Jobs” initiative to tout its partnerships with farmers “to grow foods that meet standards strict enough for tiny tummies.” Marketing creative tends to depict whole ingredients and employ messaging such as “A CLEAR choice for baby.”

Conversely, Target and online shoppers are less likely to be aware of Gerber’s organic lineup than those shopping elsewhere.

Implications for Brands and Marketers

Among the most obvious implications for marketers in the baby food business is the need to lean in on nutritional value when considering packaging, promotions, and brand voice. As nutritional value itself can mean different things to different consumers, this inherently comes with a need for consumer education. Third-party validation is also a worthy consideration. The newest brands are already zeroing in on this strategy as a way to challenge incumbents.

Yumi, for example, is making its mark by leveraging the latest advancements in technology to fuel the personalized menus it offers with an algorithm. This strategy dovetails with a strong DTC, subscription push that ties into the e-commerce opportunity. As an underrepresented channel in the baby food market, e-commerce could prove to be a boon for marketers seeking to grow existing customers or onboarding new ones.

TapResearch makes accessing real-time consumer insights as easy as Googling a topic. To dive deeper into Millennial preferences when it comes to buying baby food or build and field your own specialized consumer survey at a fraction of the cost, labor, and time involved with traditional research methods, create your FREE account here or contact sales@tapresearch.com today.