Plant-Based Burger Awareness and Preferences (Consumer Insights)

Demand for vegan meat (aka - meatless meat) in the US has soared in recent years, with retail sales of plant-based meat alternatives reaching $1.4 billion in 2021 - an increase of 74% over the past 3 years. In 2021, 19% of households purchased plant-based meat, with 64% of those buyers purchasing multiple times throughout the year. Now more than ever, consumers are clearly turning to plant-based meat alternatives. (source)

Survey Parameters

To have a better understanding of consumers' grilling habits and preferences when it comes to plant-based or meatless burger patties, using TapResearch's market research platform, we surveyed 1000 people between the ages of 18-64 (census balanced). We've summarized some of the most significant insights below, namely:

The Results

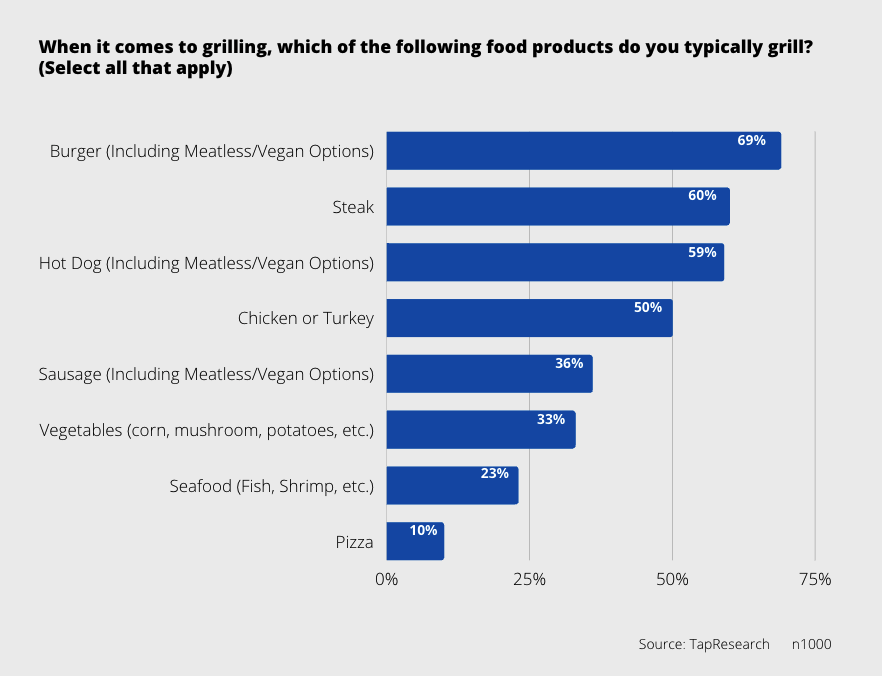

Consumer Preferences for Grilling

Burgers (including meatless burger products), hot dogs, and steaks were the top 3 choices of food products for grilling, with burgers (including meatless burger products), being the number one preferred food item at 69%. We saw no significant difference in preference by age group or gender.

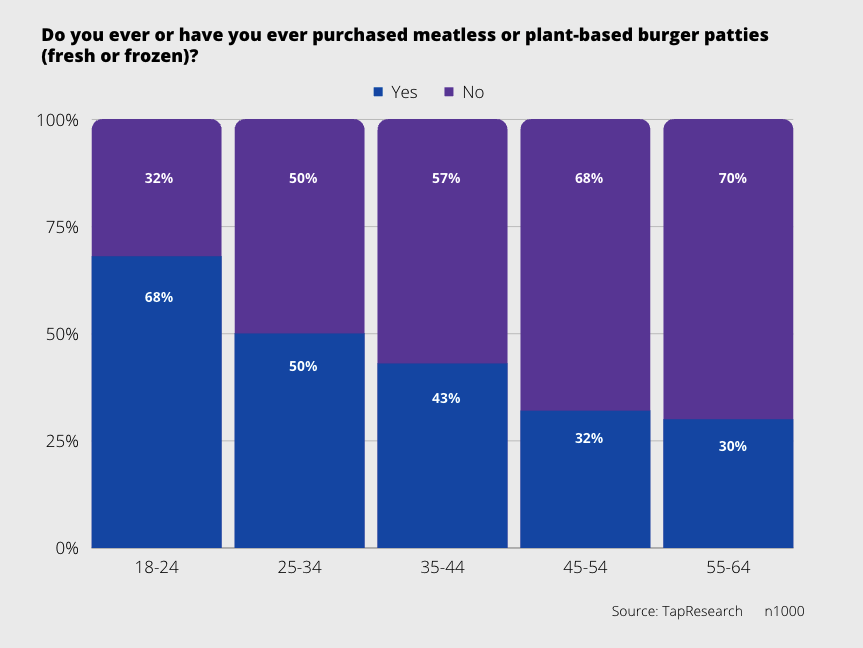

Most interestingly, our survey results indicated that the purchasing behavior for meatless or plant-based burger patties is almost equal to those who do not purchase them. 43% of respondents indicated they purchase plant-based or meatless burger patties, with purchase buyers being more concentrated among the younger age groups but being virtually the same among males and females.

Purchase Intent

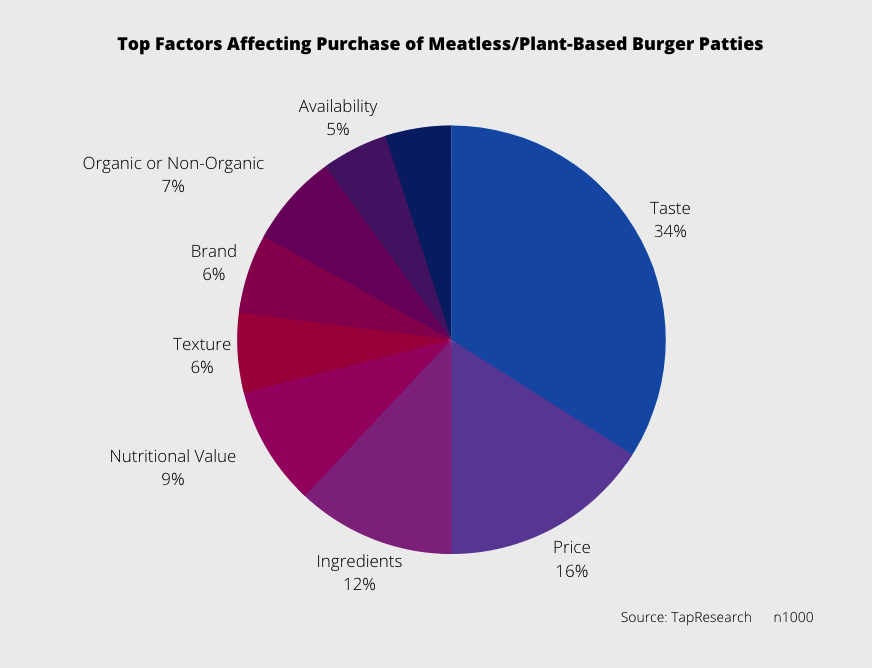

When it came to ranking product factors impacting purchase intent for plant-based/meatless patties, taste was ranked the most important factor by 34% of respondents, followed by price at 16% and ingredients at 13%.

It is notable to mention that taste was the number one purchasing factor among all age groups, except 18-24. Price came in as the number 1 purchasing factor for that younger age group of 18-24.

Brand Awareness

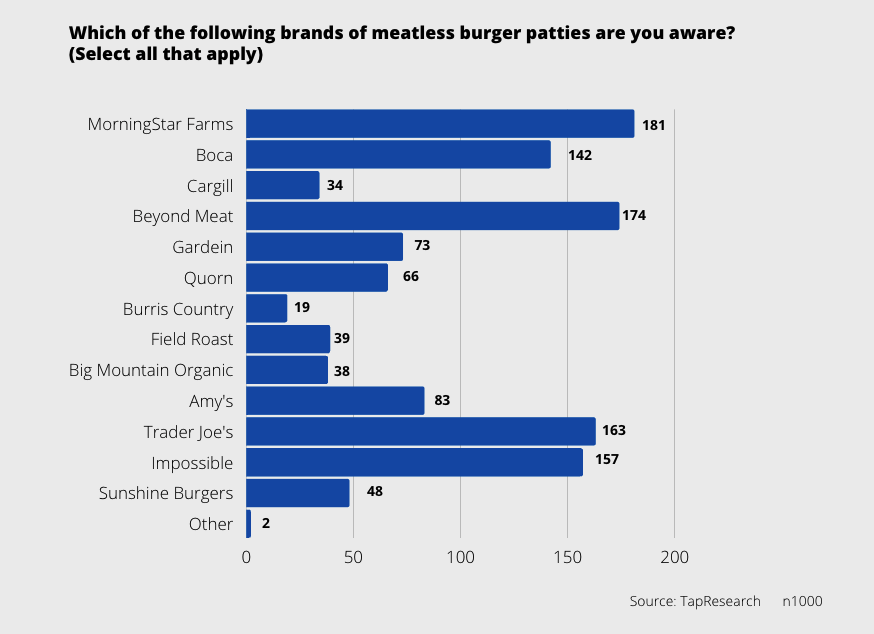

We presented respondents with 13 brands of plant-based/meatless burger patties. The top 3 brands recognized were MorningStar Farms at 42%, followed by Beyond Meat at 40%, and finally Trader Joe’s at 37%.

In addition, Trader Joe’s brand had a higher awareness among younger age groups (18-34), than all the other brands, with awareness decreasing as age increased.

Finally, awareness was slightly higher among female buyers across all brands, apart from Beyond Meat. Beyond Meat’s buyers skewed slightly towards male buyers (15% vs 14%).

Want to learn more about how Market Insights by TapResearch can help you and your team make faster, data-driven decisions with confidence? Click here to get connected with one of our experts today.